Effectively managing your money as a family can seem daunting, but implementing a solid budgeting system can bring much-needed clarity and control. There are various methods to budgeting, each with its own benefits. One popular method is the 50/30/20 budget, where you allocate 50% of your funds to must-haves, 30% to wants, and 20% to investments. Another common method is the zero-based budget, where you allocate every dollar of your income to a specific purpose.

- Think about your spending and identify areas where you can reduce.

- Track your income and spending regularly to stay on top of your budget.

- Assess your budget quarterly and make adjustments as needed.

Remember, the best budgeting method is the one that works for you. With a little planning, you can master your family finances and work towards your financial goals.

Achieving Financial Freedom: The Envelope System Explained

Are you hoping for financial freedom but feeling overwhelmed by complex budgeting methods? The straightforward envelope system might be your optimal solution. This time-tested method involves allocating your monthly income into separate envelopes labeled for distinct spending categories, like food, housing, and entertainment. By tangibly tracking your spending in this way, you gain a crystal-clear understanding of where your money goes and can make conscious choices about your finances.

- Benefits of the Envelope System:

- Elevated Financial Awareness:

- Minimized Impulse Spending:

- Streamlined Budgeting Process:

Zero-Based Budgeting Made Easy: A Step-by-Step Approach

Embarking on a journey of financial discipline can seem daunting, but it doesn't have to be. With zero-based budgeting, you gain command of your finances by allocating every dollar to a specific category. This method avoids the guesswork and promotes mindful click here spending habits. Let's dive into a step-by-step approach to make zero-based budgeting achievable for everyone.

- Begin with collecting your financial statements: income sources, monthly expenses, and any outstanding debts.

- Proceed to formulate a list of all your needs, followed by your wants.

- Distribute funds to each item based on your goals.

- Monitor your spending meticulously and make adjustments as needed.

- Evaluate your budget regularly, at least monthly, to ensure it aligns with your current financial standing.

{Zero-based budgeting empowers you to make informed financial decisions and achieve your objectives. With a little effort and commitment, you can transform your relationship with money and pave the way for a more stable future.

Easy Strategies for Successful Family Budgeting

Creating a household budget may seem overwhelming, but it's essential for financial well-being. Start by monitoring your earnings and expenses. A simple budgeting app can be effective. Group your expenses into essentials like rent, utilities, and groceries, as well as variable spending such as entertainment. Once you have a clear picture of your finances, establish realistic savings targets.

Regularly review your budget and make adjustments as needed. Embrace strategies like grocery list creation to lower food expenses. Discuss lower rates for utilities. Consider ways to boost your income through a side hustle. Remember, successful budgeting is a journey that requires dedication and flexibility.

Saving Smarts for Tight Budgets

Living paycheck to paycheck can feel a real challenge, but it doesn't have to rule your life. There are plenty of ways to stretch your funds and make ends meet, even on the tightest of budgets.

First things first, you need to get a clear picture of where your money is going. Track every expense for a month or two, no matter how small. This will reveal areas where you can trim costs. Once you know where your money is going, you can start to develop solutions.

Consider things like cooking at home more often and seeking out budget-friendly fun.

You can also talk to your service providers about discounts and opt for public transit or carpooling.

Remember, every little bit makes a difference. By embracing a frugal mindset, you can take control of your finances and achieve your financial goals.

Taking Control Your Money: A Practical Guide to Family Finances

Financial stability is a pillar for any family's wellbeing. But with the challenges of modern life, it can be difficult to stay on top of your finances. Luckily, taking control of your money doesn't have to be daunting. With a little forethought and discipline, you can create a solid financial structure that empowers your family. Start by monitoring your income and expenses, creating a realistic budget, and setting realistic financial targets.

- Build an emergency fund to handle unexpected expenses.

- Investigate different savings options, like high-yield accounts, to help your money increase.

- Encourage your children about personal finance from a young age.

Remember, every small step you take towards financial awareness makes a difference. By committing yourself, you can create a brighter financial future for your family.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Molly Ringwald Then & Now!

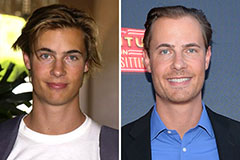

Molly Ringwald Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!